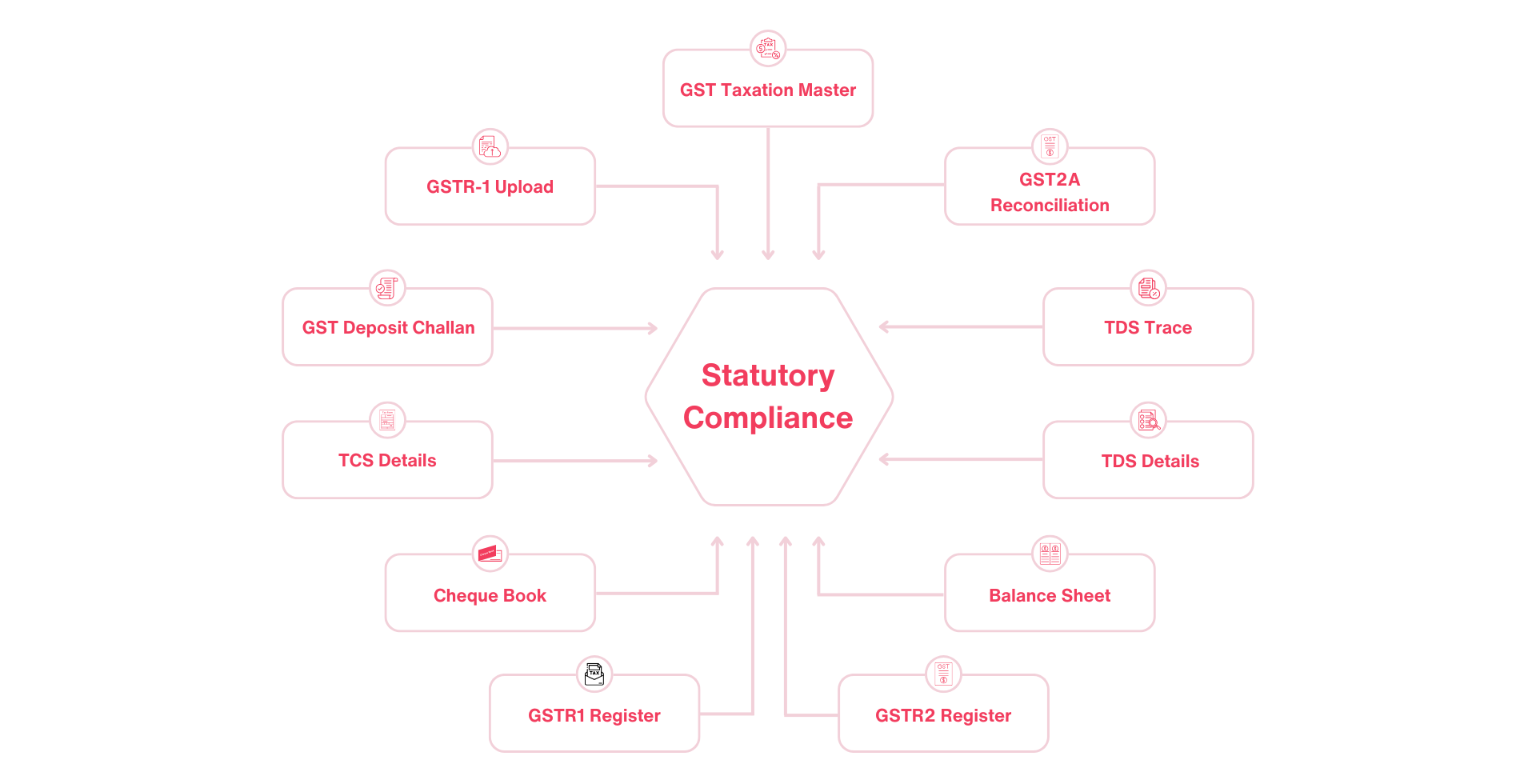

Statutory Compliance Block

The EMS (Enterprise Management System) Statutory Compliance Block makes businesses comply with all the legal, financial, and operational regulations concerning asset management and everyday activities. Streamlining compliance through automation of tracking, reporting, and documentation of compliance requirements by integrating with a highly developed ERP software can help in implementing a new system. This reduces risks, facilitates avoiding legal sentencing, and smooth running of the organization. Enterprise resource planning gives businesses the ability to manage compliance-related activities in an accurate and efficient way.

Top brands that use our platform

What is the Statutory Compliance Block?

In EMS (Enterprise Management System), the Statutory Compliance Block is targeted to facilitate the process of efficient matching of legal, financial, and operational requirements. Through the utilization of the ERP software and the enterprise resource planning, it allows businesses to comply with the government-specified laws, laws on taxation, provisions on labor, safety regulations, and environmental regulations. This helps to stick firmly to statutory requirements and kill any man-made errors, thereby enhancing greater transparency and also enhancing good government.

Key Features

GSTR-1 Upload

GSTR1 Upload in Statutory Compliances Block of EMS gives the business the opportunity to prepare and file outward supply returns into the GST portal. It will ensure compliance with GST regulations, minimize the risk of making mistakes will be minimized, and utilize the efficiency of the ERP software will be utilized to escape any penalty.

GSTR-2A Reconciliation

The Statutory Compliances Block has the GSTR-2A Reconciliation feature that enables businesses to compare purchase records, as well as the auto-generated records in the GST portal. When used together with enterprise resource planning, it will make accurate Input Tax Credit claims, remove mismatches, and enhance compliance.

GST Deposit Challan

The GST Deposit Challan component would allow businesses to create and monitor GST payment challans all in the ERP system, hence simplifying the payment process and staying in statutory compliance with simplicity.

TDS Trace

The Statutory Compliances Block has a TDS Trace feature, which automates the calculation of TDS, deduction, and reporting of TDS. Using it as integrated with the enterprise management system, it affords a real-time visibility into TDS transactions so that timely filings are made and there are no compliance errors.

TDS Details

The TDS Details feature lets businesses have a thorough record of TDS-related data. Through ERP software, it can achieve proper reporting, reconciling, and compliance with taxes.

TCS Detail

In the Statutory Compliance Block, there is a feature called TCS Detail in which businesses can manage Tax Collected at Source (TCS) effectively. It also helps in the proper collection, reporting, and conforming with the statutory regulations using the enterprise management system.

Balance Sheet

The Balance Sheet functionality shows the present status of the company in terms of financial condition. It employs enterprise resource planning to produce correct reports on assets, liabilities, and equity. This guarantees openness, adherence to legal requirements of reporting, and good decision-making.

this is how Statutory Compliances Block works